With growth looking more and more anemic in the developed world and the fundamentals (expenses outpacing revenue) clearly pointing to a lackluster demand going forward. Can products and services from the developed world find a market elsewhere? Can the Indian consumer market offer a road ahead.

Adopted from Economist, Daily Chart March 7th, 2011

Adopted from Economist, Daily Chart March 7th, 2011

A burgeoning and transitioning Indian economy with buyers on the move bodes well for businesses local and global. Do the numbers justify India’s rise or are we once again succumbing to temptations of finding growth where the fundamentals just don’t add up. Is now the time to step in and serve unmet, latent and unaddressed needs ?

In a two part analysis lets investigate what it means to do business with consumers in India analyzing fundamental drivers of demand, the market potential and the challenges of meeting those demands.

Part-I: Demystifying the Indian Consumer – Market potential, the real numbers

Part-II: Go-To Market Challenges – Leveraging networks, Igniting demand.

- O Buyer Where Art Thou

- Channels – Leverage, Make or Buy

Demand – The Holy Grail

Fundamentally there are only two ways to generate demand for any product or service:

- New Sales: Attract new buyers who have never experienced the product category or service.

- Replacement Sales: Entice existing buyers to replenish, replace or upgrade their existing product or service.

At the macro level demand is driven by population growth, income growth, productivity gains, monetary policy, trade policy, innovation that renders products accessible and affordable or changes in the regulatory environment.

At the micro level demand is stimulated by awareness, cultural norms, cheap credit, accessibility, education levels, income levels, price, technology, product quality and lifecycle.

Demystifying the Indian Consumer

The Indian market is squarely divided between the urban and the rural. A projected consumer model1 of the Indian market resembles a direction post reflecting the many possible roads businesses can take to reach the various segments.

Source: NCAER; MGI Consumer Demand Model. (Using 2010 $PPP)

Source: NCAER; MGI Consumer Demand Model. (Using 2010 $PPP)

The Globals and Strivers are where most MNC’s focus today. But it is the Aspirers and Seekers together making up about 160 million households by 2015 where the mass market will converge. The Deprived numbering 70 million will continue to march along, relegated to the sidelines and will find it increasingly difficult to break through without government support.

Note: For a detailed discussion on the consumer segments refer to the McKinsey / NCAER report: The ‘bird of gold’: The rise of India’s consumer market.

Rural and Urban Divide:

Employment Status: The most striking observation one can glean from the employment status of Rural and Urban India is that over half the workforce is categorized as being self-employed. Cash flows within this segment remains volatile something marketers need to keep in mind when projecting numbers.

Another significant proportion falls into the category of casual laborers. This base of the population survives one day at a time. Lastly, the vast majority of salaried professionals are public sector employees with a few participating in the private sector.

An average graduate earns $ 9,474 per year in leading cities, the comparable rural figure is just $ 4,789. The difference, in fact, is higher for illiterates as well –average of $ 3,684 in the elite towns versus just $ 1,184 in the villages2.

Note: The purchasing power of the Indian rupee is much higher than its exchange rate value in USD

Source: RBI Monthly Bulletin, April 2011

Source: RBI Monthly Bulletin, April 2011

Expenditures: Rural and Urban India spend almost equally on all fronts although the share of the wallet dedicated to food is marginally higher in the rural area. This can be attributed to differences in the average household size which stands at 4.7 for rural and 4.2 for urban3.

On an average, the urban Indian earns 85 percent higher than his or her rural counterpart, spends 71 percent more and saves nearly double.

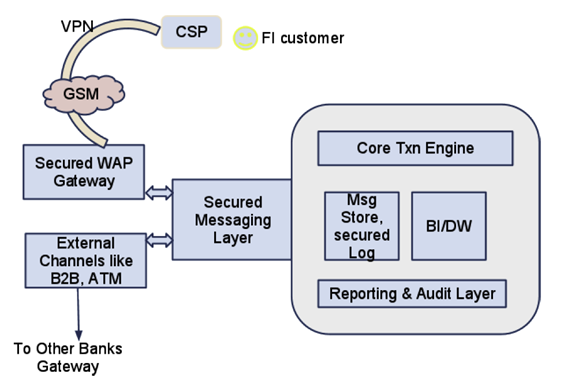

How Indian Consumers Pay:

The retail industry, with transactions valued at USD 410 billion per year4 is predominantly cash based. India’s consumer durables market was valued at around USD 33 billion5 in 2010, with electronic products (computing devices, mobile handsets and audiovisual products) accounting for almost 76%.

India has 173 million debit cards users (13%) and 23 million credit cards users (2%). However cash continues to be the only mode of transactions for the 40% unbanked population in the country. Overall, 67% of transactions are carried out in cash, while only 33% are done through electronic means6 (60% of these are P2P transactions).

The penetration of PoS terminals in India remains low at 419 terminals per million inhabitants7 (2009). On an average, the debit and credit cards together account for only two card transactions per day per PoS terminal. The economics clearly point to a need for alternate payment mechanism.

Consumers in a Transitioning Economy: A Moving Target

As a new middle class emerges across India, people will seek greater quality in what they pay for (food, housing and clothing). As incomes rise further, the same will look for convenience and pay for it. Finally once the Indian economy leaps into the league of developed nations buyers will seek customized offerings and services. This scenario has played out numerous times and each time the pattern has repeated itself in every country that made the leap from underdeveloped to the developed.

India will be no different although the needs, composition and behavior of the different segments may deviate.

India will be no different although the needs, composition and behavior of the different segments may deviate.

Note: For an in-depth look at the lifecycle in an emerging market refer to the pioneering work by Alonso Martinez and Ronald Haddock, The Flatbread Factor, the finest work to emerge from the strategy landscape over the last decade.

Moving Segments, Changing Needs

Over the years a gradual shift from a joint family system to nuclear family has taken hold across India. The trend will only accelerate further as incomes rise and people demand more freedom, expression and personal space.

India is already witnessing the arrival of new consumers expressing themselves boldly by trying and adopting new offerings triggered by:

- INCOME Effect: As the 2nd fastest growing economy, with 8% plus growth people have more to spend.

- MINDSET Change: The post liberalization population numbering 35% is just coming of age.

- AWARENESS: Access to information brought on by increased media proliferation, technology reach and 15 million foreign travellers annually.

- ASPIRATION Effect: Desire to experience new things as a consequence of moving up the value chain and the need to fit in by emulating others.

By 2015 the various consumer segments in India will demand and pay for goods and services differently. Some of the opportunities that will open up:

The Numbers Game:

When all said and done, it ultimately boils down what level of sales can the economy sustain given the consumer makeup and country specific environment they live in. The best way to gauge the health of an emerging economy is to project Consumer Durable (CD) Sales.

Consumer Durable (CD) sales are a bellwether of broader trends and underlying fundamentals in the economy. CD Sales are primarily driven by discretionary spending which correlate strongly with per capita growth in GDP earnings. CD penetration rates are a good indicator of shortcomings in the economy on account of infrastructure, credit availability and stability in household earnings.

Here is what one projection on achievable CD sales looks like and the assumptions made.

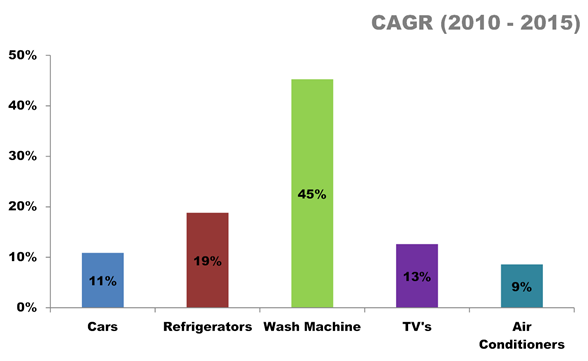

CAGR for Consumer Durable Sales (2011-2015E) One should pay close attention to the adoption rates for the basket of consumer durables under consideration. The adoption rates are a way to cross check sales projections and ensure that sales mirror the size of the consumer segments.

One should pay close attention to the adoption rates for the basket of consumer durables under consideration. The adoption rates are a way to cross check sales projections and ensure that sales mirror the size of the consumer segments.

Sizing up Demand:

To develop the same sales estimate from bottoms up one has to look at potential market size among all the available segments and put together a detailed plan to capture individual buyers. One such framework that maybe employed is depicted below.

GBL: Globals (High Income), MMI: Middle Middle Income, UMI: Upper Middle Income

I will leave it those interested to arrive at individual targets for CD sales at each of the segments under consideration.

In Part-II of this discussion we will investigate how having established a sales target one can go about selecting a Go-To Market Strategy to realize the set objectives.

Note: It may appear to the reader that I am biased towards the Indian Market. It just so happens that I can relate to the Indian market better on account of my origin and roots. The worst thing any marketer can bring to his profession is an inherent bias in selecting target markets.

A lack of in depth knowledge and expertise on China and Brazil has hampered my ability to conduct a similar analysis on their market potential.

References:

- NCAER; MGI India Consumer Demand Model

- NCAER- Inclusive Urbanization Needed, Oct-2010. The numbers are adjusted based of the 2010 $PPP.

- National Sample Survey Office (NSSO), Report No. 531

- A.T. Kearny Global Retail study, 2010

- Confederation of Indian Industries Data, Dec-2010

- Mobile Payments in India – Deloitte/ASSOCHAM, April-2011

- Bank for International Settlements

- McKinsey – Comparing urbanization in China and India, July-2010 (Pg-2)

- Energy in India for the Coming Decades, Anil Kakodkar, Chairman, Atomic Energy Commission, India

- India- Energy Efficiency report, ABB, Jan-2011 (Pg-2)

- World Bank, GDP Forecasts.

- International Energy Agency (IEA)

- International Monetary Fund (IMF)

- Planning Commission of India

- India Census – 2010

- Modeling Diffusion of Electrical Appliances in the Residential Sector, Michael A. McNeil and Virginie E. Letschert, August 2010

- Bass Diffusion Model

Update, Oct 28th 2011: The Implications of the Global Web for US Startups, Point Judith Capital (some interesting data)

Update Oct, 22nd 2011: Economist Special Report : Business in India, rightly captures the challenges of doing business in India and impediments to its growth.

Update Oct, 17th 2011: India could become one of the top 10 e-commerce hubs in the world by 2015

Update Oct, 16th-2011: Top US based corporate giants like Wal-Mart, Starbucks, Morgan Stanley, New York Life Insurance, Prudential Financial, Intel, Dow Chemical, Pfizer, AT&T, Boeing, and others lobbying hard to enter India