Article at a glance: A new breed of companies has emerged on the scène that only seem to get bigger and bigger with each passing day. The companies ranging from Cisco, Intel, Microsoft, Google, EBay, Facebook, Netflix, IBM, Alibaba to Apple have one thing in common their ability to develop platform based products and services. What gives platforms the edge and what strategies can one deploy to successfully develop platform based products or service. ( Download PDF )

A follow on article will analyze how the Android Platform has emerged from nowhere to dominate the market for Smartphones and eventually take over everything from thin-clients, cloud computing, consumer electronics and ultra mobile internet devices market.

Introduction: Why Platforms?

The relentless pursuit of globalization with diminishing borders, instant dissemination of information, ubiquitous use of information technology and swift diffusion of ideas have heralded two important changes to the competitive dynamics of companies:

- Imitation of new products and services at an alarming rate.

- Traditional sources of competitive advantage no longer guarantee sustained leadership.

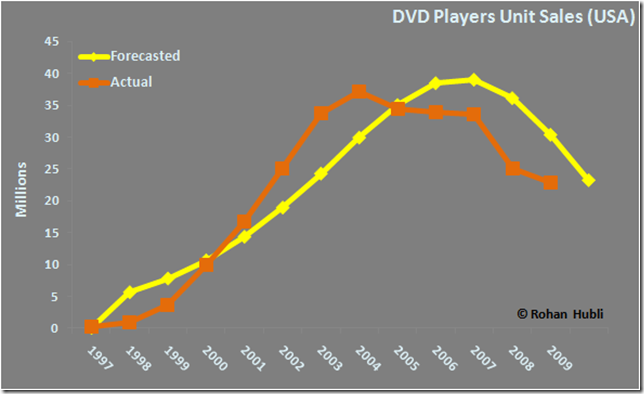

Given the state of hyper-competition it is no wonder that product lifecycles are shrinking and new competitors are emerging from nowhere to erode market share and with it revenue streams.

A company with a blockbuster product has to innovate at a rapid rate just to stay ahead of competition, a feat easier said than done. The safest bet it seemed was to add “Branding” or “Service” dimension to the product mix; intangibles that are harder to replicate. But even here the advent of ERP software, CRM systems, internet advertising and diffusion of best practices are bringing competitors and products closer than ever before.

On the other hand, a different breed of companies armed with platform based products/services seem invincible; immune from commoditization of products and services with a customer base that is deeply entrenched and group loyal.

Platforms: A platform by definition is a place (physical or virtual) where mutually interdependent players (single or multiple) conduct transactions, avail services, fulfill needs or realize an experience. An important distinction regarding platform centric products and services is their “self-reinforcing character” i.e. a core product or service whose value (benefits conferred) increases as more and more people adopt it.

A common characteristic of most platform based product or services is a participation fee and the recurring revenue streams (perpetual) generated by selling complementary products or services.

Examples: EBay, PayPal, DVD Players, Personal Computers, Google, Apple-iTunes, NTT-DOCOMO, Alibaba.

Platforms Everywhere:

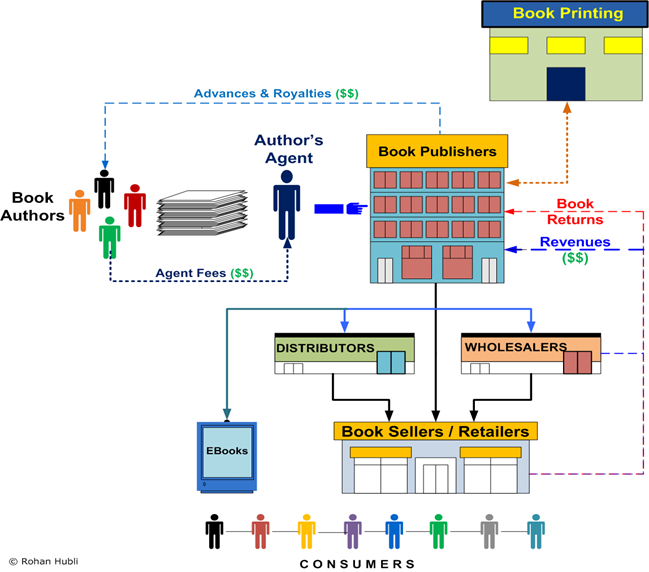

Look around you and an increasing number of products sold today are networked in some way or the other. EBay connects buyers and sellers on a virtual platform. Gaming consoles connect players with video game publishers and other players. DVD players and Televisions systems now offer an endless number of choices to provision, access and personalize content. Apple connects content producers and application software providers with end users. Google connects internet users with web sites and web portals. MasterCard, Visa and PayPal connect buyers, sellers and intermediaries with each other. Intel and Microsoft connect PC users to application software providers and other PC users. The list goes on.

What’s common to all of these players is their ability to bring together interdependent players in a way that creates value for everyone involved.

Note:

1. A key distinction between platform based products/services and internet Ecommerce sites (Ex: Priceline, E*TRADE, Amazon) is the fact that the latter restrict two individuals belonging to the same group (buyers, sellers) to derive utility from each other. A second distinction comes from the utility gained by end-users which scales for platform products/service as the number of users “N” increases while that for an internet E-commerce site has a fixed upper bound.

2. Theoretically the maximum utility derived by an end-user from a platform based product/service is a function of N i.e. Utility = F (N * N-1), where “N” is the number of active users.

What makes Platforms based products and services different?

Platforms if done right confer on the pioneering firm the following advantages:

- Lock-In due to Network Effects.

- Monopoly / Winner-Take-All dynamics.

- Perpetual Revenue streams.

- Protection from imitators and price based competition.

- Immunity against the need to innovate products faster.

Who can win the inherently risky and uncertain platform game?

Establishing a platform is an extremely risky venture where the outcome is uncertain. The odds are in favor of a firm that is:

-

Pioneer with first-mover advantage.

-

Revolutionary new idea (product / service)

-

Access to capital or with deep pockets.

-

Iron-clad patent protection.

-

Access to complementary assets.

-

Installed base and brand name.

-

Management skills to take decisive steps at each stage of the platform evolution.

Strategic Guide for developing Platform based products and services:

The strategic options available to firms considering a platform based approach to developing products and services are:

- Platform Strategy – Closed, Shared or Open

- Licensing Agreements

- Strategic Partnerships

- Subsidies

- In-House Complements

- Complement Providers

- Marketing Mix

1. Platform Strategy – Closed, Shared or Open:

The What: Platforms can be open, closed or shared.

- A platform is open if participation is unrestricted and free for one and all to join.

- A closed platform by definition is owned and controlled by one firm who decides among other things participation rights, platform features, partners and scope of complements.

- A shared platform is a joint effort by one or more firms bound together by common interests. Decisions on platform strategy are undertaken in the spirit of cooperation and commonly agreed upon goals.

The How: The decision to pursue Open, Closed or Shared platform strategy depends among other things on:

-

Barriers to Imitation

-

Possession of required complementary assets by sponsoring firm.

-

Installed base and leverage over industry participants.

-

Ability to fund big investments.

-

Availability of complementary providers with required expertise and know-how.

-

Coexistence of multiple platforms that can serve the same market profitably.

-

Cost of building the infrastructure and resources to deploy the platform.

-

Heterogeneous demands in customer needs and tastes that a single platform cannot serve.

-

Susceptibility of the platform to free rider problem.

The Risk: A closed platform allows a firm complete control and independence. However it requires a firm to have a breakthrough idea (product / service), ability to undertake large upfront investments in capital and resources and exercise leverage over other industry participants to build partnerships along the way. A shared platform in contrast allows firms to share the risk as well as rewards. Conflicts may arise with respect to platform roadmap, features, and resource allocation. In fast changing markets consensus among partners maybe slow to emerge jeopardizing the overall platform. An open platform is prone to free-rider problems, quality and control issues. Generating profits and revenue streams can be challenging with an open platform approach.

The When: A closed platform is the best way to enter the market initially when a firm wants to retain complete freedom over how the platform should evolve, who can participate, what features to offer and when. A closed platform may be a best option to recoup investments especially when a firm needs to commit large resources and undertake upfront investments. Once the platform acquires a large installed base opening the platform increases the overall value to all participants. A firm with a valuable intellectual property and fighting for acceptance within the industry may benefit from a shared approach by partnering with an industry heavyweight. When compatibility with an installed base is and winning acceptance from powerful complementors is critical a shared approach to platform development is the best way forward. An open platform serves mainly to dislodge deeply entrenched technology or in markets that are slow to take off and hence require government intervention.

2. Licensing (OEM) Agreements:

The Why: OEM Licensing can be a very potent weapon for the sponsoring firm to widen the installed base for a technology platform. An additional benefit of pursing this strategy is to co-opt competitors who posses resources to launch a superior competing technology. Licensing can be a very cost effective way of achieving wide scale market reach and penetration. Licensing also serves the purpose of ensuring that platform adopters don’t perceive the sponsoring firm as a monopolistic threat to their very existence. A firm may not have all the resources (tangible / intangible) necessary to serve all segments of the market.

The How: One way to go about achieving licensing deals is to establish a royalty fee based on unit shipments. For this to succeed the firm must have a unique offering protected by patents and perceived by others as synergistic to their core business. Another option is to actually pay adopters and complementors a portion of the revenues derived from transactions on the platform. The publicity that comes with a large number of OEM licensing deals sends a positive signal to would be adopters and complement providers of momentum behind a platform.

The Risk: A firm following this strategy should have patents that act as a barrier against imitation. Following this strategy is a sure shot recipe to value destruction in the long run if the technology behind the platform is the sole driver of revenue and value creation for the licensing firm. Competition will eventually drive down prices and erode market leadership unless the firm can innovate faster. The uncertainty surrounding platform adoption and market potential can pose challenges when structuring royalty payments.

The When: If the firm sponsoring the platform does not have a strong track record or a dominant position in the industry a licensing strategy makes perfect sense. Licensing is also important when a firm intends to establish its technology or platform as the dominant one in the industry. A firm must judiciously exercise this option at the very beginning so as to reap benefits later. However in doing so, the firm must have patents that prevent imitators for leapfrogging or have alternate sources of revenue that it can protect and sustain over a period of time.

3. Strategic Partnerships:

The Why: If launching a platform requires large upfront investments a partnership can minimize risks to both sides. A partnership is strategic and synergistic, when partners have a product portfolio and a revenue base that don’t overlap with minimal threat of encroachment. At the same time the partnership has to bring together complementary assets that each partner can leverage and deploy. Strategic partnerships can be employed as a preemptive move to diffuse powerful incumbents.

The How: One way to go about achieving strategic partnership is through cross-licensing of IP’s and patents and by establishing a royalty free licensing pool. Strategic partnerships can take the form of joint-venture, equity investments, platform co-development, joint marketing and/or sharing of complementary assets (technology, sales, distribution and manufacturing). When access to complementary assets is paramount revenue sharing can be a viable option.

The Risk: Strategic partnerships can be difficult to enforce, monitor and realize when firms have conflicting end goals. Power struggles and battles on platform evolution, roadmap and patent infringements can create challenges in developing a long term symbiotic relationship. Strategic partners may end up as formidable competitors later.

The When: If the firm sponsoring the platform cannot fund all the critical resources (capital, infrastructure and technology) and/or lacks complementary assets strategic partnerships are the way forward. Partnerships are a way for a firm to minimize risks and upfront investments in amassing all necessary complementary assets. Strategic partnerships can be very crucial when the success of a new platform depends on maintaining compatibility with an installed base or needs participation of powerful complement providers.

The main difference between Licensing Agreements and Strategic Partnership is, with the former you are proliferating the market with intent to preempt competition while the latter serves to address a shortcoming in your capability to create new markets through partnership.

4. Subsidies:

The Why: Buyers generally refrain from making upfront investments on products and services that are inherently risky or new. When the technology is still emerging it is unreasonable to expect platform users to pay a premium to adopt your product. One way to circumvent this problem is by way of subsidies that lower the price for would be adopters while recouping lost revenues through complementary services or products.

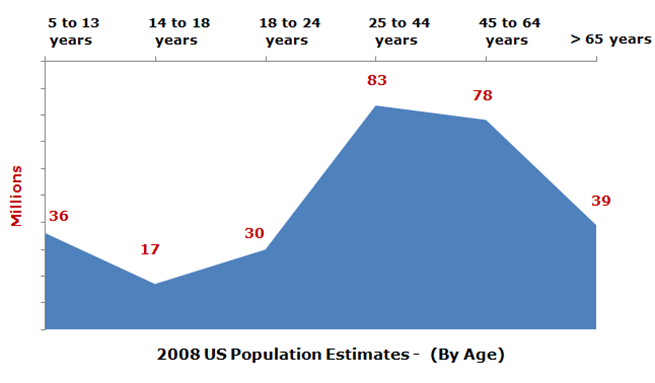

The How: To stir up a large installed base “Penetration Pricing” or “Freemium” can be the right strategy to deploy. In the extreme case where developing the platform incurs huge upfront costs (Ex: Gaming console, Personal computers, DVD players) an optimal strategy would be to subsidize platform users (higher price sensitivity segment) by pricing below cost while collecting a right-to-participate fee from platform providers and complement providers. A subsidy in the form of government rebate or tax breaks can also serve as a way to stimulate adoption but requires an open platform in most cases.

The Risk: Unless the platform sponsor (provider) has a superior technology, iron clad patent protection, deep pockets and an industry leader extracting subsidies from platform participants can be challenging. In the extreme case when complementors yield more power, the platform sponsor might be forced to settle for a smaller share of the revenues and focus on volume transactions. Care must be taken to prevent fee-riders or heavy users from abusing the platform.

The When: Subsidies are the right way to overcome resistance to adoption when the product (service) is revolutionary and requires platform participants and end users to make substantial investments or forgo sunk costs in legacy products. Subsidizes should only be offered when the platform sponsor has alternate means of recouping lost revenues in the form of platform participation or usage fee.

5. In-House Complements:

The Why: Platforms by definition suffer from a “Catch-22” or what is commonly referred to as “Chicken-and-Egg” problem. Potential platform participants (providers / complementors) will hesitate making a commitment until they are sure the investment will pay off. Likewise platform end-users will prefer to wait and watch before diving in.

In the absence of a large established user base attracting complementors whose participation is a must for end users to gain utility from the platform poses a significant challenge. Developing in-house complements become a necessity for the platform to have a life. In-house complements send a strong signal to would be platform participants that the sponsoring firm is committed behind the platform.

The How: To kick starting the self reinforcing positive feedback, the platform sponsor should be prepared to develop complements in-house at least during the initial phase. Development of in-house complements should commence early on so that the platform can be launched with complements. Bundling complements with the platform can be one approach to ensuring that the cost of developing In-House complements is recouped. In-house complements must start strong and build a stellar reputation and brand name where possible.

The Risk: Developing in house complements along with sponsoring a platform requires large investments and commitment from a firm’s management. A risk-averse firm and its manager will find it difficult to secure funding and resources when returns fail to cover the cost of capital. The problem is acute in publicly traded firms where management must withstand the scrutiny of share holders and investors alike.

The When: Developing in-house complements becomes a necessity when a platform is revolutionary, evolving and incurs irreversible sunk costs in resource and capital from external platform providers and complementors. Platforms with pioneering technology that require hand holding and a longer learning curve may also prompt a firm to develop complements in-house initially. Developing in-house complements also ensures that only high quality products reach the end users.

6. Platform Complementors:

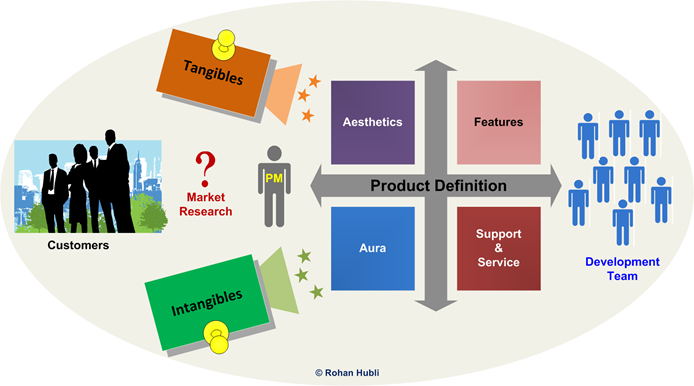

The Why: Complements enhance the value of a product by conferring additional benefits and enriching the overall experience for the end user. Complements allow a firm to establish a virtual R&D factory without the need to fund the projects. A complement may be something tangible: add-on product or an intangible: service.

The How: Developing complements requires an ability to develop relationships with multiple players and participants from all sections of the industry. It requires foresight and an uncanny ability to lead, to seek, to nurture and to develop win-win relationships. The sponsoring firm might have to fund external complementors. It must facilitate complementors to develop a viable business model that can generate revenues from the platform. An independent business unit armed with personnel, money, power and authority along with the right incentives to act in the best interest of complement providers will ensure a better chance of success. Development of technology standards that facilitate easy integration and programs that allow advanced access to technology must be instituted. The platform sponsor can consider making minority investments, taking controlling stake or signing an exclusive contract with promising complement providers.

The Risk: Complement providers may not invest the resources, talent or time to develop value added services or products for the platform. Products may suffer from quality issues or fail to meet the needs of users. If left unmonitored an influx of me-too complementors could undermine the profitability of the entire ecosystem by driving down prices through competition and imitation.

The When: The firm’s business model should clearly define its scope with respect to the platform and those of its complementors. Building trust and partnership takes time and should be prioritized constantly. Evaluation of partners that augment and enhance the platform’s overall utility to the end-user must be accorded importance at each stage of the platform’s development. In the early stages of the platform evolution complement providers that the ability to attract new users should be given priority. In the later stages complement providers that enhance platform stickiness must be sought out. As the platform evolves complement providers that bring diverse products and services should be added to the platform mix.

7. Marketing Mix:

The Why: Effective use of the marketing mix – Product, Price, Promotion and Place can make all the difference when launching a new platform. A platform that fails to solve an unmet customer need with inadequate promotion and distribution reach may fail to attract a large user base. Pricing is all the more important when establishing a new standard or platform due to the risk-averse nature of most buyers.

The How: The product should offer a value proposition unmatched in the marketplace. Targeting lead adopters and securing endorsements from key opinion leaders can be extremely beneficial. A myopic pricing policy that aims to satisfy P&L statements will only deflate adoption rates. To stir adoption and establish a wide installed base the firm must chose penetration pricing; forgoing short-term profits over long-term benefits. The firm may have to blanket the market with a full product line to meets heterogeneous segments of the market. An expansive distribution reach must follow to ensure product availability and penetration within the market. The importance of effective advertising to ease concerns regarding ease of use, compatibility, reliability and value proposition should not be overlooked.

The Risk: The platform may fail to reach critical mass forcing the firm to write down millions of dollars in marketing and R&D investments. The flip side, wide spread adoption and subsequent demand may find the firm scrambling to meet excess capacity or fulfill user requirements without scaling infrastructure. Penetration pricing requires deep pockets and the ability to fund operations in the absence of credible revenue base.

The When: The firm should spend heavily on advertisements, joint promotions and media campaigns during launch of the platform. Price aggressively early on even if it means selling at or below cost. Distribution coverage should mirror the adoption profile targeting lead adopters initially before moving to the mass market. Product and service mix should emphasize the composition of the user base with an aim to serve all needs arising on the platform check here.

Acknowledgements:

I am deeply indebted to Professor Hemant Bhargava and Professor Greta Hsu at the UC Davis Graduate School of Management and Professor Siobhan O’Mahony now with Boston University School of Management for providing me a foundation and inspiring me to pursue my passion. Thank You !